Key takeaways from the ASX Australian Investor Study 2023

I recently had the pleasure of attending the launch of ASX’s Australian Investor Study for 2023. I enjoyed learning about the latest trends in Australian investment markets at the event, where speakers discussed a range of topics, including the changing profile of investors, the most popular investment products and market trends.

I particularly enjoyed the panel discussion with industry leaders, who shared their insights on investing and financial advice. Among the topics discussed were environmental, social and governance (ESG) investing, technology's impact on investing and the importance of financial education.

The consensus is that the investment landscape is changing, with Australians increasingly investing in assets other than their homes and superannuation. According to the study, female and younger investors are also increasingly active in the market, and ESG investing is becoming more popular.

Here are some of the key themes and highlights of the study.

The changing face of investors

More Australians are investing beyond their home and superannuation. In 2023, 52% of Australian adults held investments other than their home and superannuation, up from 45% in 2020. Factors driving this trend include online investing platforms' rise and the popularity of exchange-traded funds (ETFs).

| 2020 | 2023 | |

| The adult population of Australia | 19.56M | 20.04M |

| Investor population | 9M (46% of the population) | 10.2M (51% of the population) |

| Investors with on-exchange investments | 6.6M | 7.7M |

This is an increase of 13% or 1.2 million investors since 2020. The COVID-19 pandemic may be behind at least some of this push towards new investment.

Women are also becoming more active in the investment market. The proportion of female investors in Australia has increased steadily over the past few years, and in 2023, women made up 42% of all investors. This trend is likely to continue as more women become financially independent and take an interest in their own financial future.

Diversification and attitudes to risk

The percentage of investors who believe they have a diversified portfolio has fallen from 54% in 2020 to 44% in 2023.

There are several dimensions to the diversification story.

- Gender differences: More women than men believe their portfolios need more diversification or are unsure about what it is.

- The next generation: Among all age groups, the next generation of investors exhibits the lowest level of diversification, with an average of 3.1 products held. Approximately 33% of them hold ETFs, potentially aiding portfolio diversification. Their limited diversification likely results from their relatively short investment duration and starting incomes. Moreover, their elevated risk aversion may counterbalance the lower levels of diversification. As a remedy, providing education on the role of diversification in risk mitigation and stabilising returns across various asset classes could prove beneficial for these investors.

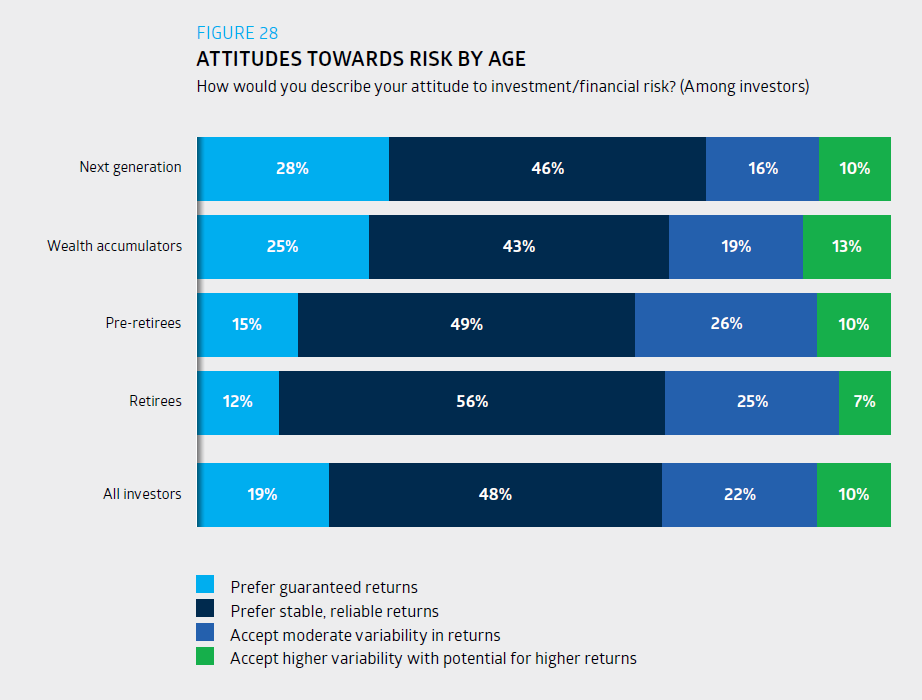

It should also be noted that investors’ preference for stability has risen since 2020. Two-thirds of investors (67%) say they prefer stable or guaranteed returns (up from 54% in 2020), while 33% would accept moderate or higher variability for higher returns, down from 46% in 2020.

And in general, younger investors had a lower appetite for risk and volatility while pre-retirees and older demographics had a higher tolerance for some variability in exchange for higher returns.

Source: Australian Investor study 2023, ASX

Source: Australian Investor study 2023, ASX

Listed products, ETF usage and cryptocurrency

ETFs are the fastest-growing assets held, with 20% of Australian investors holding at least one ETF on the ASX. This is up from 16% of the investor population in 2020.

Until May 2023, Bitcoin and Ethereum were the most widely known and traded cryptocurrencies. Bitcoin has been a direct-to-retail product for most of its life, bought from a specialist exchange – often with hardly any regulatory controls. With ETFs and other formal structures, however, the asset class is becoming more mainstream.

It’s worth noting that in the past five years, there have been 1.2 million new investors and many of them are tech-savvy and interested in investment opportunities connected to social media.

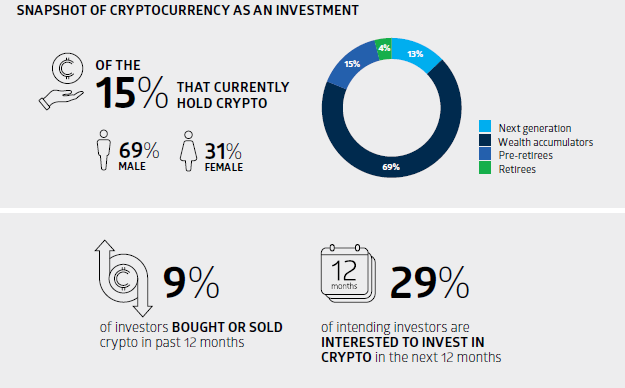

For the first time, this survey asked investors about cryptocurrency. Next generation, wealth accumulators, new investors and intending investors are the most interested in this emerging asset class. At this point, all indications point to the fact that cryptocurrencies may become even more mainstream, however at this point they still make up a relatively small portion of most investors’ overall portfolios.

The median value of cryptocurrency holdings by crypto investors is currently $5,100 or just 3% of portfolios. The largest crypto portfolio allocations across the age segments belong to wealth accumulators (7%) and next-generation investors (6%) with accumulators accounting for the highest median value ($7,200). Retirees have the lowest allocation (1%) and amount invested ($2,400). But it is investors using company structures, SMSFs and family trusts who are investing larger median amounts.

Source: Australian Investor study 2023, ASX

Source: Australian Investor study 2023, ASX

Rise of ESG investing

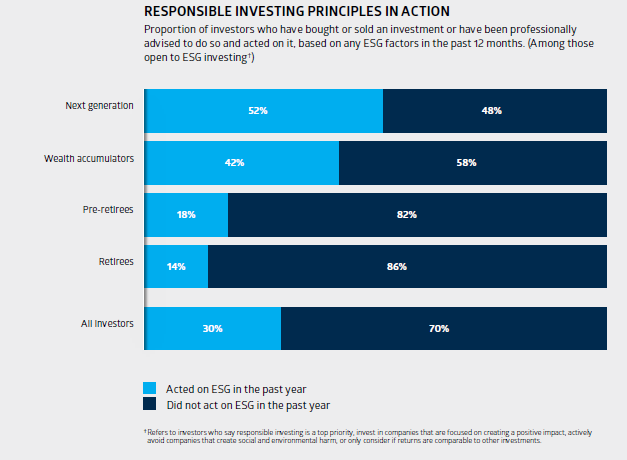

ESG investing is becoming increasingly popular. In 2023, 31% of investors said they used responsible investing principles in their approach. This trend is likely to continue as more investors become aware of their investments' environmental and social impacts.

At a high level, all investors consider a wide range of factors when making investment decisions, from returns and risk to tax effectiveness. Only 6% of investors rated ESG considerations among their top three factors when making investment decisions. This is significantly fewer investors than the 13% who prioritised ESG considerations in 2020.

Source: Australian Investor Study 2023, ASX

Source: Australian Investor Study 2023, ASX

The future of financial advice

There has been a drop in Australians turning to financial advisers to gain access to a wider range of investments (27% in 2020 vs 22% in 2023), suggesting they are less likely to turn to a financial adviser to grow or diversify their portfolio.

However, on the flip side, they are more likely to turn to a financial adviser because they don’t feel comfortable making investment decisions themselves (31% in 2020 vs 35% in 2023). The primary barrier that prevents Australians from receiving professional advice is cost, with 34% of Australians saying advice is too expensive, up from 24% in 2020.

Among SMSF investors, over half received some form of professional advice (54%) in the previous 12 months – 32% from financial advisers and 23% from an accountant. Compliance requirements drive the need to use accountants in particular.

According to the study, SMSF investors look to advisers for different reasons than ordinary investors. They predominantly turn to them to access a wider range of investments (32%). They also turn to them to generate investing ideas which they use to conduct research themselves and decide whether to invest (25%). They also like to use advisers to test their own ideas about where to invest (22%). This suggests that SMSF investors are confident in their investing ability and turn to professional advice largely to extend their opportunities, thereby increasing their portfolios' level of diversification, minimising risk and validating their own ideas.

See our webinar for more insights

For more key insights on the ASX Investor Study, see our webinar with Rory Cunningham, Senior Manager of Investment Products from the ASX: Embedded content: https://youtu.be/-2DxXbygpqY?si=uwQwBTo8Rt9B6zmW

The role of fintechs such as Sharesight

The research findings served as both a source of pride and validation for Sharesight, underscoring the platform's significant impact on the investing journeys of our users and customers. Our core mission revolves around empowering investors with the necessary tools and information to make well-informed decisions, thus cultivating greater financial acumen.

Whether investors prefer a self-directed approach or seek professional advice, Sharesight equips them with smart and intuitive investing tools, empowering them to take charge of their financial destinies. Our comprehensive features and resources are designed to facilitate seamless investment tracking, comprehension of tax obligations and the ability to rigorously test investment strategies for optimal results.

Become a savvy investor with Sharesight

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors using Sharesight to see the true performance of their investments. Sign up and:

- Track all your investments in one place, including stocks in over 40 major global markets, mutual/managed funds, property, and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income (upcoming dividends)

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account to start tracking your performance (and tax) today!

FURTHER READING

Announcing the Sharesight Fintech Scholarship's 2024 winner

We are pleased to announce the 2024 winner of the Sharesight Fintech Scholarship, Temiremi Egwuenu, who is studying Applied Finance at Macquarie University.

Effortlessly track clients’ trades with Sharesight and Desktop Broker

Sharesight has integrated with Desktop Broker, allowing advisers to have their clients’ trading data automatically synced to Sharesight’s portfolio tracker.

Red flags: When should you avoid investing in an asset?

This article explores some of the “red flags” you should look out for when considering an investment for your portfolio.