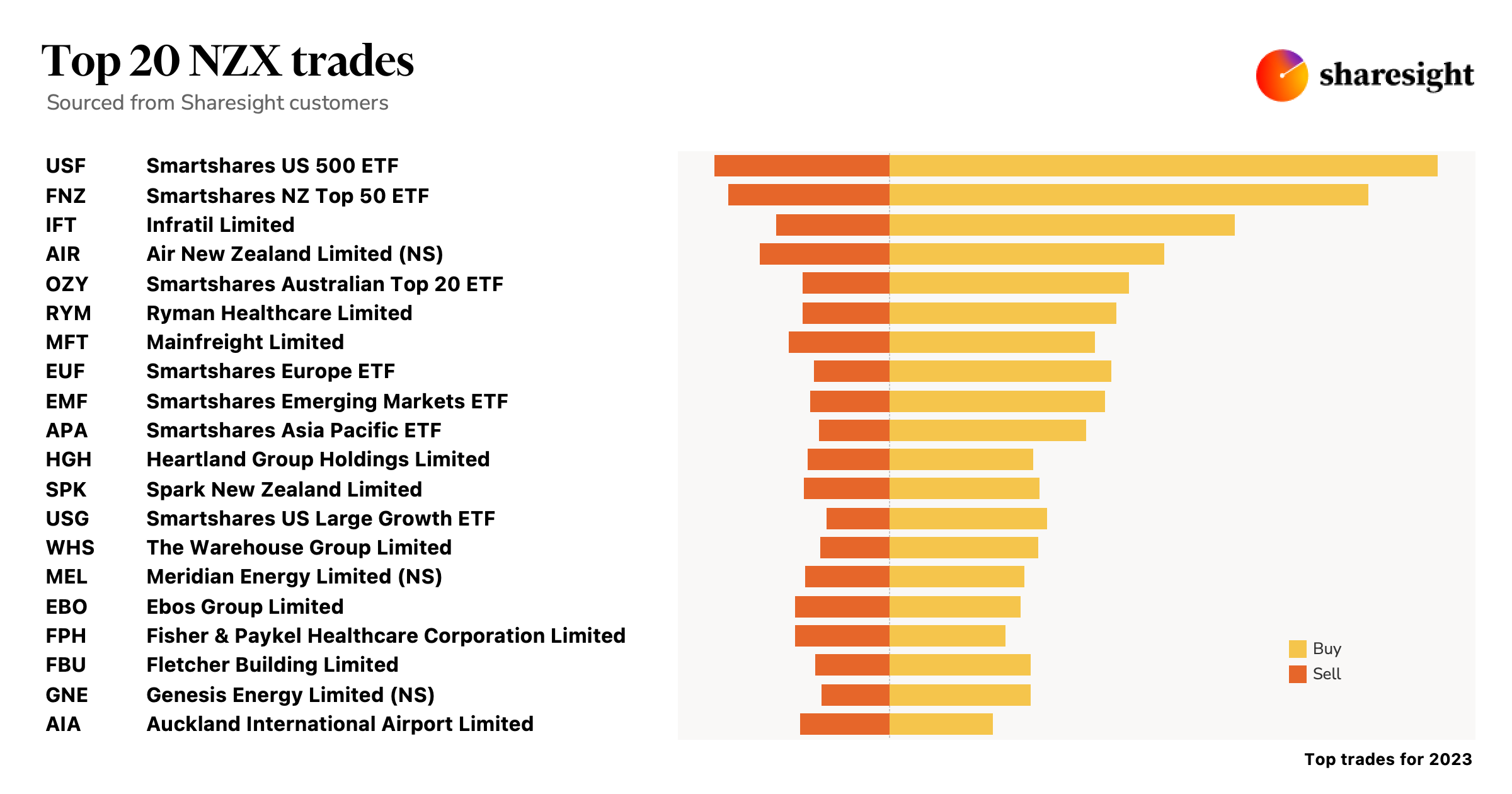

Sharesight users' top 20 trades on the NZX for 2023

Each year, Sharesight looks back at the top 20 buy and sell trades made by Sharesight users throughout the year. Welcome to the 2023 edition of our annual trading snapshot, where we explore the top trades users made in stocks on the NZX this year, plus the market-moving news behind some of these stocks.

Sharesight users’ top 20 NZX trades in 2023

In this yearly snapshot, trades were strongly led by Smartshares’ US 500 (NZX: USF) and NZ Top 50 (NZX: FNZ) ETFs.

In terms of individual stocks, trades were led by Infratil (NZX: IFT), which saw its share price rise steadily throughout Q2, largely remaining stable for the rest of 2023 and ending the year up almost 14% (as at the time of publishing).

Trades were followed by Air New Zealand (NZX: AIR), which saw its share price peak in September, following a steep decline throughout Q4, ultimately ending the year down almost 15%.

It was a varied year overall, with the top trades spanning stocks in the infrastructure, aviation, healthcare, logistics and utilities sectors.

Let’s look at the news behind some of the key stocks in this year’s snapshot:

Infratil (NZX: IFT)

- January: Infratil joins NZ 50 stock rally into 2023

- May: CDC Data Centres and One NZ propel Infratil earnings results

- July: Plans to acquire 80% stake in Console Connect

- August: Infratil shareholders displeased with growing director fees

- October: Infratil increases stake in Kao Data from 49% to 53%

- November: Infratil more than doubles first-half net profit to NZ$1.2 billion

Air New Zealand (NZX: AIR)

- January: Air NZ reports significant passenger growth YoY; outlook positive for 2023

- February: Air NZ back in the black amid growing travel demand

- March: Resumes Bali flights after 3-year hiatus

- April: Air NZ increases FY23 profit forecast due to strong demand and cheaper fuel

- May: Plans to invest NZ$3.5 billion in aircraft over next five years

- July: Auckland Airport upgrade woes sour relationship with Air New Zealand

- August: Air NZ signals strong customer demand for FY24; declares first dividend in 3 years

- September: Warns of challenges ahead due to rising fuel prices and increased competition

- October: Air NZ warns of lower Q2 profits due to volatile fuel prices, growing competition and uneven travel demand

- November: Air NZ poised to continue discounting flights due to reduced demand

- December: Expects first-half earnings to be within lower end of forecast

Ryman Healthcare (NZX: RYM)

- January: Ryman gets approval for AU$317 million Mt Eliza retirement village

- February: Undertakes NZ$902 recapitalisation to repay US private placement debt

- March: Ryman aligns with Solar Bay to build NZ’s first retirement village solar farm

- May: Australian operations now contribute 25% of underlying profit

- November: Posts lower half-year profit amid slowing property market

Mainfreight (NZX: MFT)

- February: Mainfreight share price benefits from overseas rebound of logistics sector

- May: Posts record annual profit but warns of upcoming slowdown

- July: Mainfreight reveals plummeting pre-tax earnings in Q1 results

- November: Mainfreight reports plunging first-half profit amid slowing global trade

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

- Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis and future income

- Run tax reports including taxable income (dividends/distributions), capital gains tax (Australia and Canada), traders tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

4 ways to prepare your investment portfolio for retirement

In this blog, we discuss retirement planning for investors, including four important factors every investor must consider.

Evaluate your investment returns with the performance report

One of Sharesight’s most popular reports, the performance report gives you the full picture of your portfolio’s returns over any chosen period.

Sharesight product updates – May 2024

This month's focus was on expanding our broker support and streamlining the customer onboarding journey, as well as additional reporting and holding functions.